U.S. listed companies must comply with the SEC’s periodic disclosure requirements. The problem for reporting companies is that company disclosures and omissions can become the basis of liability claims and governmental investigations. In the following guest post, Liz Dunshee and Nessim Mezrahi consider the ways that companies can use data analytics to guide their disclosure decisions. Liz is a shareholder at the Fredrikson & Byron law firm and Nessim is co-founder and CEO at SAR LLC. A version of this article previously was published on Law360. I would like to thank Liz and Nessim for allowing me to publish their article as a guest post on this site. I welcome guest post submissions from responsible authors on topics of interest to this site’s readers. Please contact me directly if you would like to submit a guest post. Here is Liz and Nessim’s article.

***********************************

When it comes to disclosure, today’s market volatility and regulatory factors require public companies and their advisers to confront competing demands of transparency and protection. Companies must adhere to expanding required and voluntary disclosure frameworks to comply with laws, access capital and garner high support from investors in director elections.[1]

However, each public disclosure creates a high-severity risk for directors and officers: If the company misstates information, it may lead to private rights of action and government investigations.[2]

Following the U.S. Supreme Court‘s dismissal of a writ of certiorari in late November in Facebook Inc. v. Amalgamated Bank, Meta Platforms Inc. — previously known as Facebook — must now defend against a multibillion-dollar securities class action for alleged violations of U.S. Securities and Exchange Commission Rule 10b-5.

As summarized by the Associated Press, the plaintiffs’ claims are premised on the “[i]nadequacy of the disclosures [that] led to two significant price drops in the price of the company’s shares in 2018, after the public learned about the extent of the [Cambridge Analytica] privacy scandal.”[3]

Data and analysis by SAR LLC indicate that during the 12-month period from Oct. 1, 2023, through Sept. 30, 2024, 211 companies faced private securities fraud litigation for alleged violations of Sections 10(b) and 20(a) of the Exchange Act, and Rule 10b-5 promulgated thereunder, whereby shareholders have claimed approximately $556.7 billion in market capitalization losses.[4]

During the salient period, defendant issuers have paid approximately $3.02 billion in monetary settlements to resolve securities class actions in North America.[5]

This article explores how this data can inform decisions about whether and how issuers disclose information, and why the corporate controller is well positioned to oversee this element of the disclosure analysis. We refer to this concept as “disclosure controllership.”

Transparency and risk can be balanced through responsible disclosure controllership.

Predisclosure Materiality Assessment

The decision of whether to share a development publicly, and the extent of information to disclose, often turns on whether the information is material.[6]

Public companies, and their directors and officers, may face securities fraud and derivative lawsuits if investor plaintiffs can plead sufficient facts that, if true, would indicate an issuer materially misstated information that it disclosed, or that it omitted from disclosure a fact that a reasonable investor would have been substantially likely to view as having significantly altered the total mix of information made publicly available.[7]

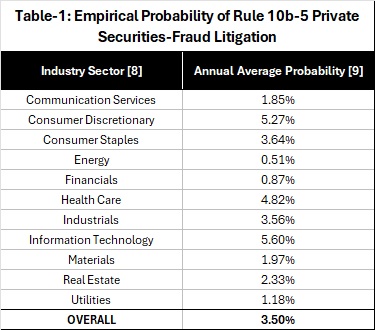

The annual probability of an issuer being sued by investor plaintiffs for alleged fraud-on-the- market is approximately 3.5%, based on the filing frequency exhibited during the aforementioned 12-month period. Table 1 below presents the probability of suit by industry sector.

In evaluating materiality, companies must evaluate all relevant facts and circumstances, including financial impact and qualitative considerations.[10] Although it is already common for the company’s controller or chief accounting officer to serve as a member of a cross- functional disclosure committee that monitors corporate disclosure triggers, three recent developments make the controller’s disclosure committee role more important than ever — and warrant greater focus on the function of disclosure controllership.[11]

First, litigation trends show that plaintiffs are scrutinizing disclosures outside of the mergers and acquisitions context, and that companies are facing an increasing magnitude of market capitalization losses on financially material disclosures.[12]

These losses negatively affect long investors and heighten the importance of predisclosure materiality assessments. According to Scott Musoff, co-deputy head of Skadden Arps Slate Meagher & Flom’s securities litigation group, “[w]e predicted that as market caps increase, the same percentage of [stock price] declines become greater alleged losses.”[13]

Second, companies are facing vast disclosure requirements and expectations, which require tracking and processing large amounts of data while adhering closely to internal procedures. For example:

- Many companies now publish sustainability reports that include data points on greenhouse gas emissions and transition risks, workforce demographics, and more, which can serve as the basis for securities fraud lawsuits even though the disclosures are not required by the federal securities laws and are not filed with the SEC.[14]

- In applying SEC disclosure rules, courts have recognized the need to describe known material events and uncertainties, and recent developments suggest that companies also should have procedures to inventory and consider disclosure if events materialize that their risk factors warn about in general terms.[15][16]

- The SEC has extracted penalties from several companies in recent years based on alleged misalignment between disclosures and internal documentation.[17]

For these reasons, proactive companies are applying concepts from their existing internal controls to disclosures outside of their financial statements. It is more important than ever to document the quantitative and qualitative elements of materiality assessments, and use a consistent framework for disclosure decisions.

Controllers — who already have oversight responsibility for a company’s financial statement reporting protocols, including filing submissions with the SEC as well as familiarity with the company’s operations — are well positioned to support these processes.[18] Controllers are not only able to provide data to assist with the materiality analysis, but they can also leverage their established systems to track materiality determinations for matters outside of financial statements and maintain backup for data-based disclosure points.[19]

According to Deloitte, “[c]ontrollers can add strategic value by working with business leaders, including the CFO, to reassess disclosures and report on accounting treatments, as well as other metrics that matter to investors, to best unlock or convey the value of the company.”[20]

Lastly, it is important to note that when a development becomes publicly known, regulators and investor plaintiffs often point to material stock price movements to make after-the-fact challenges to materiality determinations and disclosure decisions.[21]

Historically, it has been extremely difficult to predict the impact of company-specific news on stock price. Emerging data analytics tools, such as ongoing event study analyses that test stock price reactions to corporate events, may change this.

Controllers will be well positioned, in collaboration with investor relations teams, to use these tools to evaluate whether similar developments at peer companies have correlated with statistically significant stock price movements, after controlling for extraneous factors, and to incorporate this data-driven analysis to support disclosure recommendations.[22]

Mechanism and Context of Disclosure

In addition to involving controllers in the predisclosure materiality analysis, companies can enhance disclosure controllership by understanding how the mechanics and context of disclosure correlate with securities litigation risks.

Companies should plan all aspects of an announcement with an eye toward balancing transparency and risk, including the day and time of the release, and whether to combine news about multiple positive and/or negative developments.[23]

For example, based on a review of 777,140 corporate events over a two-year period on 4,661 New York Stock Exchange- and Nasdaq-listed companies, the disclosure channel of press release versus SEC filing is correlated with whether a corporate disclosure results in a material stock price movement from the dissemination of company-specific information.[24]

Single-firm event studies were used to determine that 5.41% of the close-to-close trading sessions exhibited a financially material change in stock price when an event was disclosed in both a press release and SEC filing, rather than just one or the other.[25]

Data and analysis indicate that close-to-close market capitalization losses associated with the corresponding 10,055 adverse corporate events amounted to $8.9 trillion, or 13.64% of the aggregate market capitalization of NYSE- and Nasdaq-listed companies as of Sept.13.[26]

Meanwhile, only 2.15% and 1.66% of corporate disclosures disseminated exclusively through either SEC filings or via press announcements, respectively, exhibited financial materiality when applying the same 95% confidence standard.[30]

In some situations, companies are expressly required to disclose information by way of an SEC filing, and there are also times when making an SEC filing reduces overall risk exposure.[31] In other situations, however, companies may have more discretion over whether to make a disclosure by press release, SEC filing or both.

These findings underscore that this is not a decision to make lightly. Disclosure committees, with insight from corporate controllers, should consider current data points about disclosure methodologies alongside their regulatory obligations, liability risks and other factors.[32][33][34]

Postdisclosure Financial Materiality Assessment

While companies may not have a uniform, formulaic approach to determining materiality prior to disclosure, the postdisclosure determination of financial materiality is less ambiguous. In the context of assessing open market securities fraud claims, courts have widely accepted event studies to support the postdisclosure analysis.[35]

According to Solicitor General Elizabeth Prelogar, “To assess whether a particular event or news report caused a change in a stock’s price, event studies isolate company-specific (as opposed to market- or industry-wide) price movements in the stock and evaluate whether such movements were statistically significant around the time of the event or report.”[36]

The securities litigation risks facing public companies are driven by the frequency and severity of corporate disclosures that exhibit financial materiality.

Companies and their insurers can therefore also use data derived from the uniform application of event study analysis to monitor their risk exposure following a corporate disclosure, as well as to monitor a company’s risk profile over time, based on how the frequency and severity of their material disclosures compare to those of peers.

This data can inform decisions about corrective actions and future disclosures, as well as help companies and insurers plan for potential claims and adopt risk transfer solutions. Within the company, the corporate controller is well positioned to track this postdisclosure data and share it with other decision-makers to foster disclosure controllership, which will more effectively mitigate securities litigation risks.

Data analytics is a critical component of a disclosure controllership framework.

Today’s vexing complexity of adequate corporate disclosure was in full display at the Supreme Court, when in late November the justices opted not to issue a ruling in Facebook v. Amalgamated Bank, thereby allowing a securities class action to proceed against the company in the U.S. Court of Appeals for the Ninth Circuit.[37][38][39]

The highest court in the land has potentially expanded the temporal scope of risk factor disclosures by allowing the October 2023 ruling by the Ninth Circuit to stand, which stated that “shareholders adequately pleaded falsity as to the statements warning that misuse of Facebook users’ data could harm Facebook’s business, reputation, and competitive position, and the district court erred by dismissing the complaint as to those statements.”[40]

To make disclosure adequacy even thornier for issuers, the securities plaintiffs bar is relying on increasingly sophisticated data analytics to actively monitor pension fund investment portfolios to follow securities transactions, examine losses and notify clients right away when losses may be due to fraud or other securities laws violations.[41][42]

Public companies — and their advisers and insurers — can leverage data analytics that apply the court-approved event study methodology to support predisclosure materiality determinations and monitor postdisclosure risks.

Although notable declines in stock price pursuant to corporate disclosures “aren’t an automatic trigger for shareholder suits, of course,” according to Reuters, companies may benefit by incorporating stock price reaction analysis of company-specific news into their controller’s role to build a more robust disclosure controllership framework.[43]

_______________________________________________________________________________________

Liz Dunshee is a shareholder at Fredrikson & Byron PA. Nessim Mezrahi is co-founder and CEO at SAR LLC.

The opinions expressed are those of the author(s) and do not necessarily reflect the views of their employer, its clients, or Portfolio Media Inc., or any of its or their respective affiliates. This article is for general information purposes and is not intended to be and should not be taken as legal advice.

[1] See, e.g., 2024 Benchmark Policy Guidelines, Glass Lewis 86-87, Nov. 16, 2023. https://www.glasslewis.com/wp-content/uploads/2023/11/2024-US-Benchmark- Policy-Guidelines-Glass-Lewis.pdf (noting that “[w]hen companies have not provided for explicit, board-level oversight of environmental and social matters and/or when a substantial environmental or social risk has been ignored or inadequately addressed, [Glass Lewis] may recommend voting against members of the board”).

[2] See 15 U.S.C. § 78j (2010) and 17 C.F.R. 240.10b-5 (1992), which provides that companies are liable for material misstatements or omissions, regardless of whether the information is provided voluntarily or in response to a legal requirement, and regardless of whether the information is provided in an SEC filing or elsewhere.

[3] Facebook Inc. v. Amalgamated Bank, No. 23-980 (Nov. 22, 2024); “Supreme Court Allows Multibillion-Dollar Class Action to Proceed Against Meta,” Associated Press, Nov. 22, 2024. https://apnews.com/article/supreme-court-meta-facebook-lawsuit- 9173ad92e11df4b2a565418e419dfb88.

[4] 3Q 20204 U.S. SCA Rule 10b-5 Exposure Report, SAR, Oct. 10, 2024. The quantum of aggregate market capitalization losses excludes 24 defendant companies for which insufficient data was present to perform the event study analyses under SAR standards of quality. https://www.sarlit.com/sca-rule-10b-5-exposure-report.

[5] ISS Securities Class Action Services; Rule 10b-5 Securities Class Action Settlements in North America.

[6] See TSC Indus. Inc. v. Northway Inc., 426 U.S. 438, 449 (1976) (holding that in the context of assessing securities fraud, information is considered “material” if there is “a substantial likelihood that a reasonable shareholder would consider it important in deciding how to vote,” or “a substantial likelihood that the disclosure of the omitted fact would have been viewed by the reasonable investor as having significantly altered the ‘total mix’ of information made available”); Basic Inc. v. Levinson, 485 U.S. 224, 238 (1988) (holding that “with respect to contingent or speculative information or events,” materiality “will depend at any given time upon a balancing of both the indicated probability that the event will occur and the anticipated magnitude of the event” (quoting Sec. & Exch. Comm’n v. Texas Gulf Sulphur Co., 401 F.2d 833, 849 (2d Cir. 1968)). In the absence of certain fact- specific situations, such as when a company is conducting an ongoing securities offering or when it has triggered a duty to update information that it has previously provided, U.S. federal securities laws do not impose a general duty to disclose all material information. See Basic, 485 U.S. at 239 n.17 (stating “silence, absent a duty to disclose, is not misleading”).

However, U.S. stock exchange rules promote transparency from listed companies by requiring prompt disclosure of material information. NYSE Rule 202.05; Nasdaq Rule 5250(b)(1).

[7] This article focuses on private rights of action, but public companies may also be subject to civil and criminal enforcement proceedings brought by the SEC’s Enforcement Division or the Department of Justice. See 15 U.S.C. § 78j; 17 C.F.R. 240.10b-5. Directors and officers may also face shareholder derivate lawsuits that accompany a Rule 10b-5 private securities- fraud class action. See, “Guest Post: Derivative Litigation: Board Lessons and Takeaways,” Greg Markel, Giovanna Ferrari, and Sarah Fedner, Seyfarth Shaw LLP. The D&O Diary, Oct. 4, 2023. https://www.dandodiary.com/2023/10/articles/shareholders-derivative- litigation/guest-post-derivative-litigation-board-lessons-and-takeaways/#more-25247.

[8] Global Industry Classification Standard (GICS) is a widely used industry taxonomy developed by MSCI and Standard and Poor’s.

[9] The estimated average percentage of publicly traded companies that trade via common stock or ADRs on the NYSE or Nasdaq that may become defendants within a twelve-month period.

[10] See TSC Indus., 426 U.S. at 449; Basic, 485 U.S. at 238; Exchange Act Form 8-K: Questions and Answers of General Applicability, U.S. Securities and Exchange Commission (June 24, 2024), https://www.sec.gov/rules-regulations/staff-guidance/compliance- disclosure-interpretations/exchange-act-form-8-k#104b.05 (+see, Questions 104B.07, 104B.08, and 104B.09 emphasizing the qualitative aspects of the materiality analysis under the SEC’s cyber disclosure rule); Staff Accounting Bulletin No. 99, 64 Fed. Reg. 45,150, 45,151 (Aug. 19, 1999) (publication of Staff Accounting Bulletin); Selective Disclosure and Insider Trading, 65 Fed. Reg. 45150 (Aug. 24, 2000) (publication of adopting release).

[11] Ernst & Young & Society for Corporate Governance, Corporate Governance in Focus: Harnessing Disclosure Committees for Modern Reporting, EY (July 2024), https://www.ey.com/content/dam/ey-unified-site/ey-com/en-us/insights/financial- accounting-advisery-services/documents/ey-corporate-governance-in-focus-disclosure- committee.pdf.

[12] U.S. Securities Litigation Risk Report, SAR, Sept. 23, 2024. https://www.sarlit.com/us- securities-litigation-risk-report.

[13] “Report: Securities Fraud Losses Claimed Balloon in First Half of 2024,” Ellen Bardash, July 15, 2024, Law.com. https://www.law.com/2024/07/15/report-securities-fraud-losses- claimed-balloon-in-first-half-of-2024/.

[14] “92% of S&P 500® Companies and 70% of Russell 1000® Companies Published Sustainability Reports in 2020, G&A Institute Research Shows,” BusinessWire, Nov. 16, 2021. https://www.businesswire.com/news/home/20211116006064/en/92-of-SP- 500%C2%AE-Companies-and-70-of-Russell-1000%C2%AE-Companies-Published- Sustainability-Reports-in-2020-GA-Institute-Research-Shows.

[15] Item 303 of Regulation S-K requires companies to “focus specifically on material events and uncertainties known to management that are reasonably likely to cause reported financial information not to be necessarily indicative of future operating results or of future financial condition. This includes descriptions and amounts of matters that have had a material impact on reported operations, as well as matters that are reasonably likely based on management’s assessment to have a material impact on future operations.” In describing results of operations, Item 303 also requires companies to “[d]escribe any known trends or uncertainties that have had or that are reasonably likely to have a material favorable or unfavorable impact on net sales or revenues or income from continuing operations.” 17 C.F.R. § 229.303(b)(2)(ii)). The U.S. Supreme Court has held that a company’s “pure omission” to disclose known trends cannot serve as the basis for a private securities fraud claim, but companies may still be liable for “misleading half-truths.” See Macquarie Infrastructure Corp. v. Moab Partners LP, 601 U.S. 257, 258 (2024).

[16] See, e.g., Opinion (For Publication), United States Court of Appeals for the Ninth Circuit, In Re Facebook, Inc. Securities Litigation, Case No. 22-15077 (allowing claims to proceed based on alleged failures to disclose past events in risk factors); Yi Xiang v. Inovalon Holdings Inc., 254 F. Supp. 3d 635 (S.D.N.Y. 2017) (finding that Item 303 of Regulation S-K requires discussion of material “known trends or uncertainties,” which may include the effect of pending tax changes). The SEC also has alleged that Item 105 of Regulation S-K requires issuers to disclose when specific past events that their risk factors warn about in general terms have materialized. See Facebook to Pay $100 Million for Misleading Investors About the Risks It Faced From Misuse of User Data, U.S. Securities and Exchange Commissions (July 24, 2019), htps://www.sec.gov/newsroom/press- releases/2019-140. An October 2024 enforcement action against victims of the SolarWinds cybersecurity breach also took issue with “hypothetical risk factors.” Unisys Corp., Exchange Act Release No. 11323 (Oct. 22, 2024). A joint dissenting statement from Commissioners Peirce and Uyeda objected to the burden that this expectation imposes on companies. Hester Peirce and Mark Uyeda, Commissioners, Sec. & Exch. Comm’n, Statement Regarding Administrative Proceedings Against SolarWinds Customers (Oct. 22, 2024).

[17] Activision Blizzard Inc., Exchange Act Release No. 96796 (Feb. 3, 2023); First Guaranty Bancshares Inc., Exchange Act Release No. 97631 (May 31, 2023); Charter Commc’ns Inc., Exchange Act Release No. 98923 (Nov. 14, 2023); Unisys Corp., Securities Act Release No. 11323, Exchange Act Release No. 101401(Oct. 22, 2024).

[18] What Is A Controller in Finance? Role And Responsibilities,” Ilana Hamilton, Brenna Swanston, Keith Duff, Mar. 22, 2024, Forbes adviser. https://www.forbes.com/adviser/education/business-and-marketing/become-a- financial-controller/.

[19] See “Charting a New Course For Controllers In The Post-Pandemic World,” CFO Insights, Deloitte, April 2021. Noting that, “[i]n the absence of a chief data officer, the controller is strategically positioned to oversee the collection, organization, analysis, and governance of financial data to provide the information needed to support critical decisions.”

[20] Id.

[21] U.S. Securities Litigation Risk Report, SAR, Sept. 23, 2024. https://www.sarlit.com/us- securities-litigation-risk-report.

[22] Event studies, which are widely accepted to support post-disclosure financial materiality assessments, will become more accessible to companies on a pre-disclosure basis as emerging tools allow users to quickly analyze large data sets. See infra note 23.

[23] Companies may employ various tactics to attempt to soften the market impact of negative news and/or frustrate plaintiffs’ ability to prove loss causation. See Ed deHaan, Terry J. Shevlin & Jake Thornock, Market (In)Attention and Earnings Announcement Timing, 60 J. Accounting & Econ 3/1-/25 (2014) (finding that earnings reported after hours and on busy earnings days are significantly worse than those released at other times); The Friday Night Dump, Footnoted, https://www.footnoted.com/ (focusing on important information contained in Friday filings); Pelletier v. Endo Int’l PLC, 439 F. Supp. 3d 450 (E.D. Pa. 2018) (rebuking executives for waiting to announce corrective information until they had offsetting good news); Caroline Crenshaw, Commissioner, Sec. & Exch. Comm’n, Statement Regarding Information Bundling and Corporate Penalties (Sept. 3, 2021) (calling for stricter enforcement policy for information bundling).

[24] U.S. Securities Litigation Risk Report, SAR. Sept. 23, 2024. https://www.sarlit.com/sca-rule-10b-5-exposure-report.

[25] The applied event study parameters account for a one-year control period prior to the two-year evaluative period to test statistical significance of the residual return over the impacted close-to-close trading session at the 95% confidence standard.

[26] SAR ACE (Adverse Corporate Event) Database, www.sarlit.com. As of Sept. 13, 2023.

[27] Global Industry Classification Standard (GICS) is a widely used industry taxonomy developed by MSCI and Standard and Poor’s.

[28] High-Risk Adverse Corporate Events that correspond to statistically significant negative stock price declines after controlling for general and industry-specific factors when issuers disseminated disclosures via press releases and SEC filings.

[29] Aggregate market capitalization losses that correspond to all High-Risk Adverse Corporate Events.

[30] SAR ACE (Adverse Corporate Event) Database, www.sarlit.com. As of Sept. 13, 2023.

[31] For example, in addition to events that SEC rules require companies to disclose on Form 8-K regardless of materiality, companies with ongoing securities offerings tend to disclose potentially material information on Form 8-K so that it is incorporated by reference into extant registration statements. 17 C.F.R. § 230.408 (2024) (requiring a prospectus to include any material information as may be necessary to make the information in the prospectus not materially misleading); 15 U.S.C. § 77i (2024) (imposing liability for a materially untrue statement or omission); 17 C.F.R. § 240.10b-5 (prohibiting the use of any materially untrue statements or omissions when purchasing or selling securities).

[32] See, e.g., NYSE Rule 202.05; NYSE Rule 202.06, which encourage listed companies to quickly issue a press release about any news or information that might reasonably be expected to materially affect the market for its securities, and generally discourage releasing material news within 15 minutes after the Exchange’s official closing time.

[33] Additional liability risks may attach to information disclosed in an SEC filing. See 17 C.F.R. § 240.13a-15 (2024) (applying disclosure control and procedure requirements to information required to be disclosed in reports filed or submitted under the Exchange Act); 15 U.S.C. § 77k (2024) (providing for liability for false and misleading registration statement disclosures, without requiring proof of scienter).

[34] Disclosure committees may consider whether the disclosure channel sends an unintended message about the importance of the information or establishes an undesired precedent for future disclosures. Filing or furnishing information on Form 8-K is not itself an admission that the information is material. Selective Disclosure and Insider Trading, supra note 7. However, the market may perceive disclosure on Form 8-K as more likely to be material than information distributed solely by press release.

[35] See “Materiality and Magnitude: Event Studies in the Courtroom,” David Tabak and Frederik Dunbar, Nat’l. Econ. Rsch. Assocs., Working Paper No. 34, 1999, noting that “[o]ne of the most important measurements that can be derived from an event study is that of the materiality of the event under consideration.”

[36] Brief for the United States as Amicus Curiae Supporting Neither Party, Goldman Sachs Grp. Inc. et al. v. Ark. Tchr. Ret. Sys., 594 U.S. 113 (2021) (No. 20-222).

[37] Facebook Inc. v. Amalgamated Bank, No. 23-980 (Nov. 22, 2024); see also Facebook Inc. v. Amalgamated Bank Oral Argument, C-SPAN, Nov. 6, 2024. https://www.c- span.org/video/?538151-1/facebook-inc-v-amalgamated-bank-oral-argument.

[38] “High Court Quietly Pulls Meta Case Without a Ruling,” Jessica Corso, Law360, Nov. 22, 2024. https://www.law360.com/securities/articles/2264599/high-court-quietly-pulls-meta- case-without-a-ruling.

[40] See “U.S. Supreme Court Dismisses Facebook Case, Saying Writ Improvidently Granted,” Kevin LaCroix, The D&O Diary, Nov. 24, 2024. https://www.dandodiary.com/2024/11/articles/securities-litigation/u-s-supreme- court-dismisses-facebook-case-saying-writ-improvidently-granted/.

[40] Opinion (For Publication), United States Court of Appeals for the Ninth Circuit, In Re Facebook Inc. Securities Litigation, Case No. 22-15077.

[41] Robbins Geller Rudman & Dowd LLP Portfolio Monitoring Program. https://www.rgrdlaw.com/services-investor-portfolio-monitoring-program.html.

[42] “Securities Litigation 101: Portfolio Monitoring Best Practices,” Christopher Lometti, Richard E. Lorant. Cohen Milstein Sellers & Toll, Oct. 27, 2022. https://www.cohenmilstein.com/portfolio-monitoring-best-practices/.

[43] “Big Firm Litigators Are Amped Up for 2023,” Alison Frankel, Dec. 30, 2022. https://www.reuters.com/legal/government/big-firm-litigators-are-amped-up-2023- 2022-12-30/.