In the following guest post, Nessim Mezrahi and Stephen Sigrist analyze financial market trends to assess the recent variances in the U.S. securities litigation risk. Nessim Mezrahi is co-founder and CEO, and Stephen Sigrist is a senior vice president, at SAR LLC. SAR previously published this data on their U.S. Securities Litigation Risk Management Report – Nov. 2025, here. I would like to thank Nessim and Stephen for allowing me to publish their article on my site.

***********************************

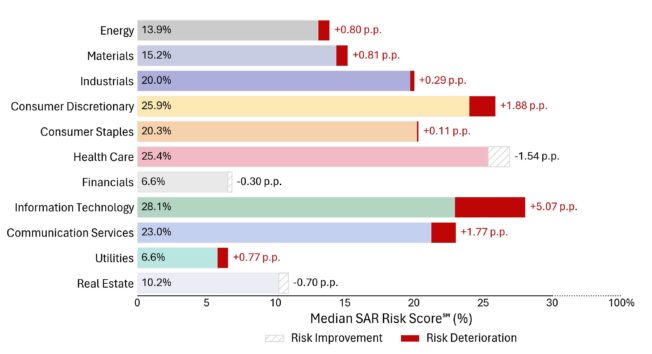

Empirical results of single-firm event study analysis on the universe of corporate disclosures disseminated by all issuers in the NYSE and NASDAQ indicate an increase in deterioration of securities litigation risk after the tumultuous stock market performance in November.[1]

Securities litigation risk manifests through corporate disclosures that prompt a material decline in stock price. Adverse corporate events, or corporate disclosures that disclose company-specific information that cause a statistically significant negative residual return in stock price over a single trading session, have a higher likelihood of triggering a private-securities fraud investigation or a class action for potential violations of Sections 10(b) and 20(a) of the Exchange Act and U.S. Securities and Exchange Commission Rule 10b-5 promulgated thereunder.

To access table endnotes, please attain the monthly securities litigation risk trends report in the link below at [1].

According to Doug Greene of BakerHostetler, “[a] securities class action asserts that the defendants made false or misleading public statements. The theory of the lawsuit is that the allegedly false statements made the stock price higher than it should have been and that when the alleged “truth” came out about those statements, the stock price dropped to its “true” value.”[2]

A verifiable increase in the frequency and severity of adverse corporate events negatively impacts the securities litigation risk profile of any U.S. or non-U.S. issuer that trades in the NYSE or NASDAQ. An issuer with a greater number of corporate disclosures that materially impacted participants in the market, demonstrably increases their risk of defending a securities class action. This is particularly pertinent as shareholders demand clarity and transparency on returns tied to record AI-related capex investments.[3]

According to Jonathan Weil of the Wall Street Journal, “[t]here also could come a point when investors grow tired of companies pouring so much capital into developing AI models and products, with little visibility into future returns. That is when the AI ecosystem conceivably could hit a wall, and where the parallels may lie with the original internet bubble and the circular deals of that era. Circularity can be virtuous on the upside, and vicious on the downside. The deals can work fine, until they don’t.”[4]

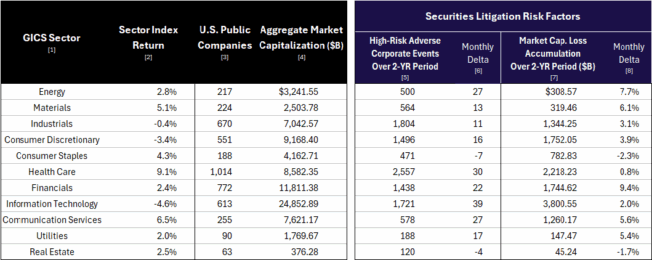

As reported by SAR on July 31, 2025 – securities litigation risk – measured and tracked according to the market capitalization loss accumulation linked to high-risk adverse corporate events over a two-year period, set a new high of $11.8 trillion.[5]

November’s stock market volatility contributed to an increase of approximately $2 trillion in the two-year market capitalization loss balance – from $11.8 to $13.7.[6] Between June 30th and November 30th, 2025, issuers in the NYSE and NASDAQ have faced an increase of 806 high-risk adverse corporate events. Despite aggregate U.S. market capitalization expanding by $10.7 trillion, or 15.3%, the rate of market capitalization loss accumulation outstripped the burgeoning increase in equity values. Overall, the U.S. market capitalization loss balance linked to high-risk adverse corporate events grew 1.5 percentage points faster during the salient period, reaching 16.7%.

Our securities analytics research indicates that deterioration in securities litigation risk will place greater underwriting scrutiny on D&O insurance coverage and premium adequacy based on an issuer’s two-year corporate disclosure record. It makes common sense that public companies that demonstrate lower frequency and market capitalization losses linked to adverse corporate events are better risks. Conversely, a public company that demonstrates higher-than-average frequency of adverse corporate events, coupled with greater market capitalization losses per corporate disclosure relative to their peer group, may more than likely face an increase in their D&O insurance premium in 2026.

__________________________

[1] SAR U.S. Securities Litigation Risk Management Trends – November 2025, here.

[2] “Overview of Securities Class Actions,” Doug Greene, BakerHostetler, Nov. 11, 2025. https://www.bakerlaw.com/insights/overview-of-securities-class-actions/

[3] “Buybacks take backseat as AI drives record US capex spending,” Johann M. Cherian, Reuters, Oct. 27, 2025. https://www.reuters.com/business/finance/buybacks-take-backseat-ai-drives-record-us-capex-spending-2025-10-27/

[4] “Is the Flurry of Circular AI Deals a Win-Win – or Sign of a Bubble?” Jonathan Weil, The Wall Street Journal, Oct. 22, 2025, here.

[5] “Securities Litigation Risk for U.S. Public Companies Increased by $1.8 Trillion in 2025,” SAR, July 31, 2025. https://www.prnewswire.com/news-releases/securities-litigation-risk-for-us-public-companies-increased-by-1-8-trillion-in-2025–302518026.html

[6] SAR U.S. Securities Litigation Risk Management Trends – November 2025, here.